“Explain to me how, exactly, we ‘leak’ money?” I was repeatedly asked this by a CEO I worked for. The challenge, of course, is the word “exactly”.

Read any commentary about fraud during 2020 and you cannot help concluding that it significantly grew. Covid-19 created a perfect storm for fraud; whether that be through fraudulent contracts or claims against the $Bn’s made available by governments, or through fraud hidden within the growth in eCommerce. My (painful) experience over 40 years tells me that organised criminals will have invested $M’s during 2020 and will have made an extremely healthy profit. It also tells me that many companies that have had to rapidly develop remote working practices and accelerate their on-line selling to survive, will have created a perfect environment for revenue ‘leakage’. This ‘leakage’ will be made up of many little (or not so little) failures – incorrect pricing, invoicing, refunding, fulfilment, and no change control on orders, to name only a few! I wonder how internal and external auditing of processes has been done during 2020? It is difficult to audit processes even when sitting on someone’s shoulder; so remotely?

Coming back to the original question about how money ‘leaks’…. Over the years, at NW/A, we have developed both a ‘macro’ and ‘micro’ approach to explaining and managing leakages, all of which is underpinned by Albert Einstein’s great quote, “If you can't explain it simply, you don't understand it well enough.”

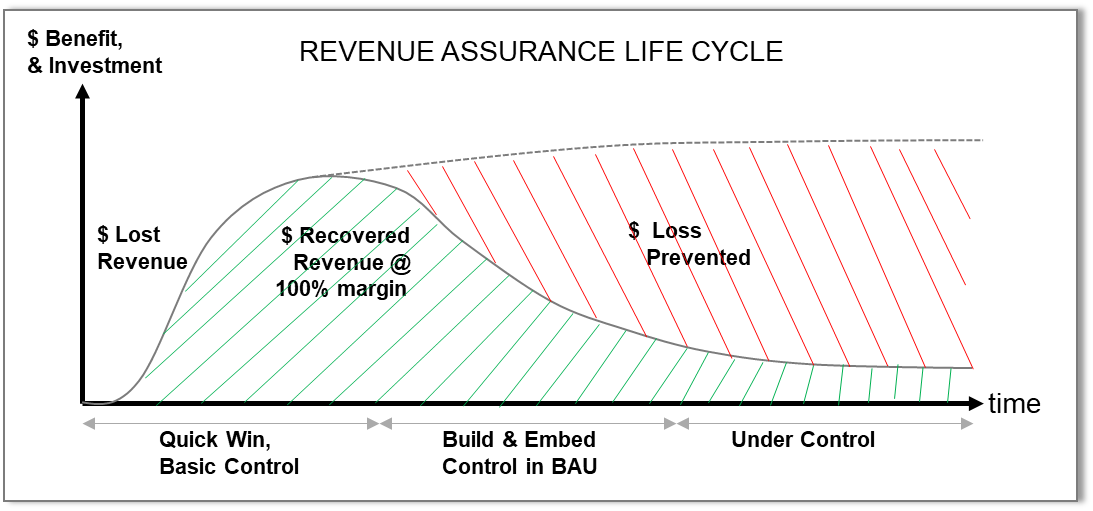

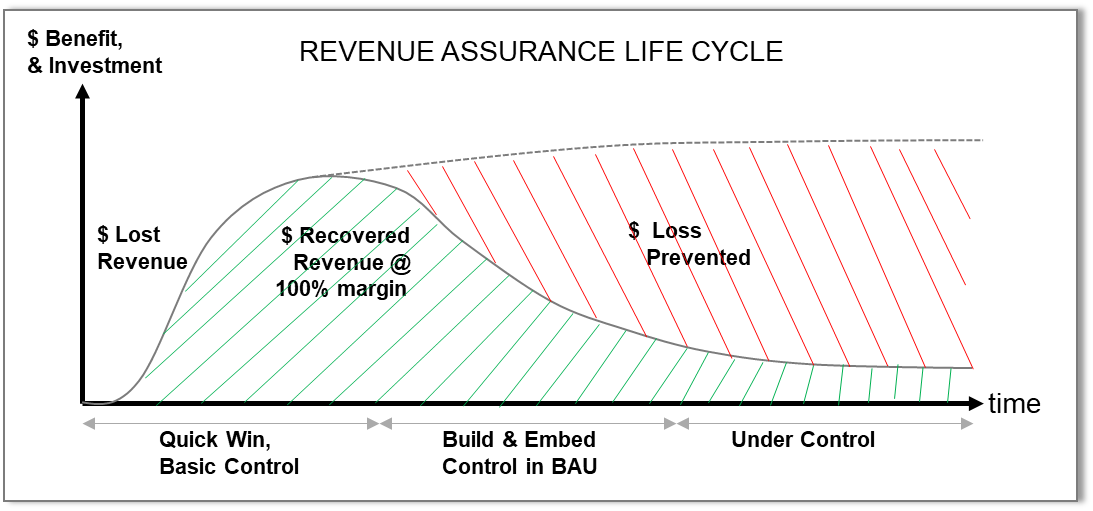

We start by explaining the macro ‘business case’ view of Revenue Assurance (RA) i.e. RA being what we collectively call the business process(es) that address revenue (and profit) ‘leakages’. The diagram below is the theoretical view of the RA Life Cycle; we’ve see this graph turn to actual money many times. It is worth spending time digesting the power of this macro view.

In our many years working in RA, within which we include Fraud losses, we have learnt that very few business leaders really understand that if you can stop the leaks, that ‘lost’ money invariably all becomes profit. The full cost of the products and services delivered are accounted anyway, whether the revenue is stated or not. That is the subtlety of the RA business case. If you can stop leakage of 2.5% in a low margin business of only 25%, your gross profits could rise by 10%, along with the capital value of the company.

Unfortunately, some business leaders do not believe this ‘macro’ view of RA when presented – it is “too good to be true”. That is when the ‘micro’ view of ‘leakage’ becomes key and that requires the skill of “story telling”, the art of making the leakage irrefutably understandable with the detail of how ‘exactly’ the loss happens. If you cannot explain that, you do not know how it happens!

Once the CEO was convinced of ‘how’ leakage occurred I quickly got the question “remind me ‘why’ does money leak?”. And the answer to the “why” is the real issue to understand in order to fix the leakages.

If you would like to discuss this article further or enquire about a free Business HealthCheck please contact us at NW/A.